Royal LePage’s national year-end home prices forecast has been upgraded as the real estate market reaches a tipping point.

Advertisement: Click here to learn how to Generate Art From Text

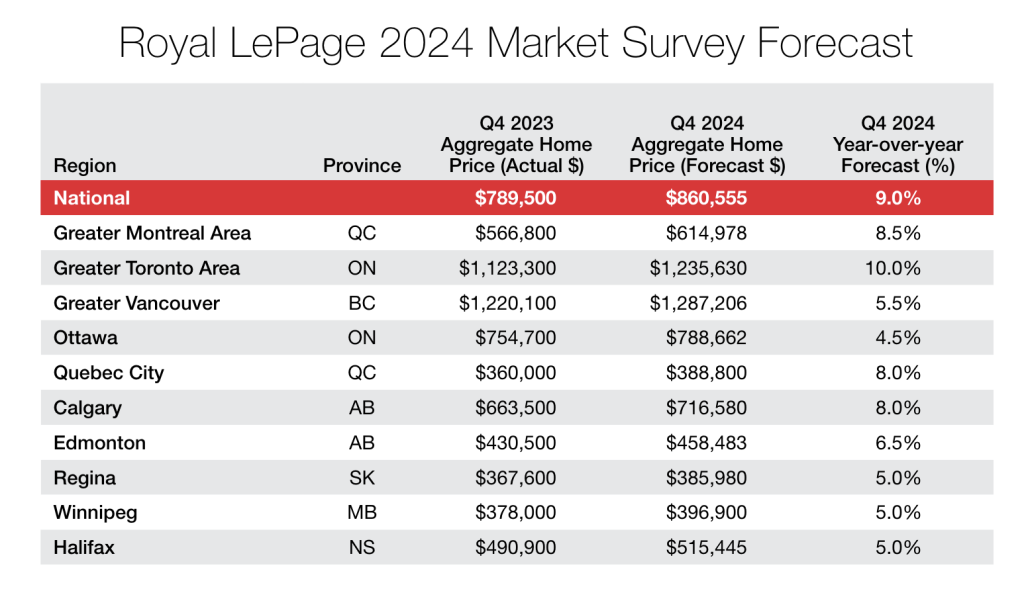

In its House Price Survey released today, Royal LePage forecasts the aggregate price of a home in Canada will increase by 9 per cent in 2024’s fourth quarter, compared to the same period last year. This figure increased by 4.3 per cent over the past year to $812100 in the first three months of 2024. This was higher than expected.

The national average home price rose by 2,9%, which indicates that buyers who were previously sidelined are now entering the market in anticipation of anticipated interest rate reductions.

Motivated buyers try to beat rising prices

“Consistent with our previous forecast, the market did reach a critical tipping point in the first quarter of 2024, when home prices bottomed out and began to appreciate again. Clearly, more and more buyers are motivated by the need to get ahead of rising home prices, rather than adopting the strategy of waiting for mortgage rates to fall,”Phil Soper, Royal LePage’s president and CEO.

In the first few months 2024, the Canadian housing market saw a significant increase in sales and price appreciation. Since July 20, 2023, the Bank of Canada’s rates have remained constant through six review cycles, prompting many buyers to enter the housing market ahead of the anticipated competitive spring sales season.

After the rate cut, we expect to see a rise in buyer activity and price appreciation.

“Many consumers – particularly first-time buyers – who have the capacity to transact have accepted and adapted to the higher borrowing cost environment. Thus, the modestly rising home prices we are experiencing today,”Soper continues. He expects that the price increase and buyer activity will increase once the central banks makes its first rate cut, which is highly anticipated.

According to the Royal LePage National House price Composite, the median home price in Canada has increased by 4.5 percent year-over-year, to $845,000. Condominium prices have increased by 3.5 percent to $591.900.

Supplies still critically low across the country

Housing supply across the country remains critically low despite a surge in listings as the spring season approaches. This shortage continues as the primary driver for rising home prices. It overshadows the impact of the interest rate reductions.

While Canada’s housing market has yet to fully recover from the post-pandemic correction, the aggregate home price remains above pre-pandemic levels. Toronto and Montreal are expected to outpace Calgary in terms of home price increases.

Federal government moves

The federal government has proposed a number of measures to combat the housing crisis and affordability crisis. This includes initiatives to increase housing construction, and rental supply. Experts, however, emphasize the importance of policies that encourage rapid home construction and rental accommodation investment to address affordability concerns.

Canada welcomed 470,000 permanent residents last year. If this growth continues, CMHC estimates that another four million homes would be required by 2030 to reach affordability levels of 20 years ago. However, the federal government announced it’s working to reduce the number of temporary residents from 6.2 per cent to 5 per cent of the national population by 2027.

“The reduction of non-permanent residents, which includes international students, should have a material impact on Canada’s extremely tight rental market, easing the rate at which rents are rising by reducing competition for limited properties,”Says Soper “This move comes at a cost, however. Non-permanent residents are critical to addressing our labour shortages and are an important engine of economic growth. We will undoubtedly be easing quotas up again in the near future.”

Read the full article Here is a link to the article.

‘ Credit:

Original content by realestatemagazine.ca – “National year-end home price forecast upgraded as real estate market hits tipping point: Royal LePage”

Read the complete article at https://realestatemagazine.ca/national-year-end-home-price-forecast-upgraded-as-real-estate-market-hits-tipping-point-royal-lepage/