Canada’s Recession Indicators And Bank Of Canada Rate Cuts

Advertisement: Click here to learn how to Generate Art From Text

The rate markets have been stable over the last few weeks. Bank of Canada rate announcementOn the 6th of March, it seemed that this was still the case with a decision by the Bank of Canada to keep rates at their current level. The Bank of Canada noted that wage pressures were easing. The Bank of Canada is scheduled to release its Summary of DeliberationsFor this decision on 20th March.

According to a report by Edge Realty, 75 basis points (0.75%) of rate reductions this year may not be enough, with the initial cut expected next week.

The report suggests that economic activity is cooling faster than the BoC acknowledges. Rate cuts of up to 1.50% are predicted for this year. In the fall, there will be extensive deliberations on the need for rate reductions of 50 basis points at the October and December meetings.

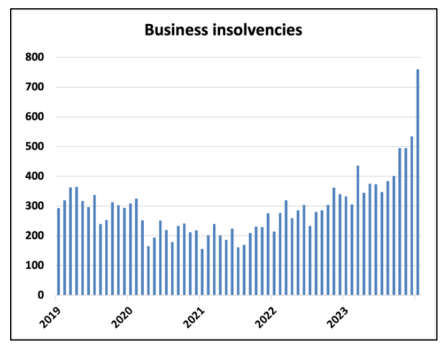

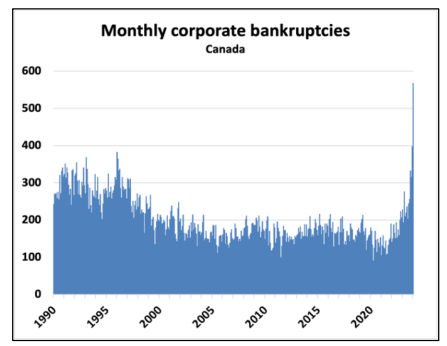

Business Insolvency

These predictions are based upon the fact that businesses face significant obstacles. Insolvencies among businesses reached their highest levels since 2006. The highest levels of business insolvencies since 2006 were recorded in January. CBC reports that the number of business insolvencies has increased by 41% over the past year. When focusing on corporate bankruptcy specifically, as a part of total business insolvencies the figures are extremely high, surpassing traditional charts and measures.

Edge Realty March 2024 Metro Deep Dive

Edge Realty March 2024 Metro Deep Dive

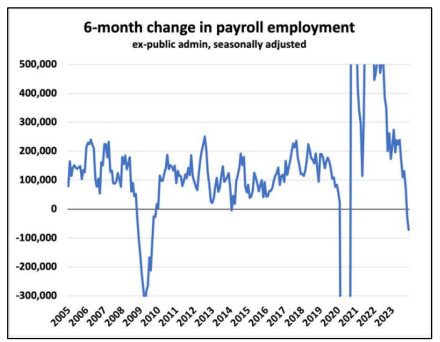

Labour Market Downturn

Another factor that has contributed to these forecasts is the apparent downturn in labour markets. When business operations begin to slow down for an extended period of time, this is reflected on the labour market. The current issues in the business world are beginning to show. Private sector payrolls have declined over the last six months, marking a first since the pandemic locksdowns, and even before that, the 2008 Financial Crisis.

Edge Realty March 2024 Metro Deep Dive

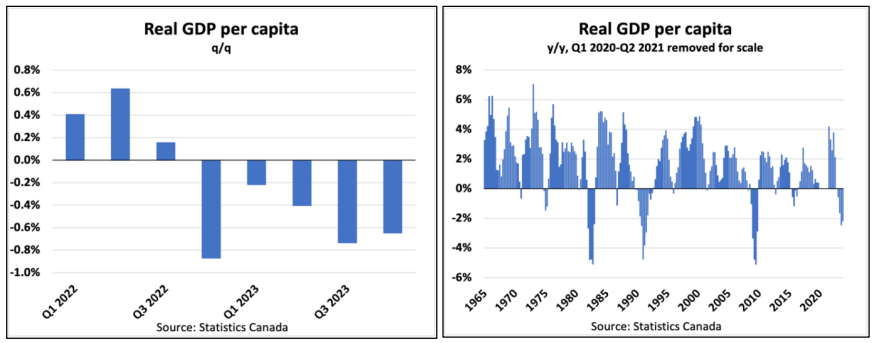

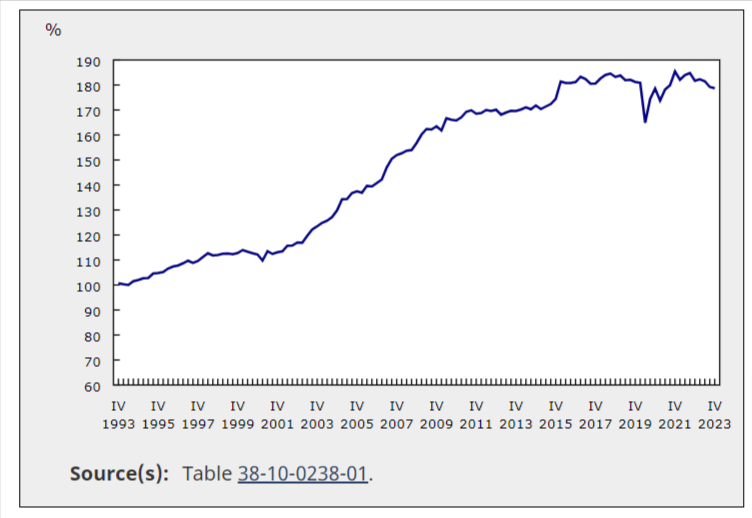

GDP Per Capita Drops

Canada has also seen its GDP per capita decline for five quarters in a row. It is also falling at the same rate as it did during recessions past.

This means that the increase in headline GDP can be attributed to the expansion of the population rather than a rise in output per person. It would be acceptable to keep population growth at 3%, but it is unlikely to happen given the current federal government restrictions on study and work permits, which are the main drivers of non-permanent resident expansion. If population growth slows down within the next 18-months, which is likely to happen, it will eliminate a significant boost in GDP growth.

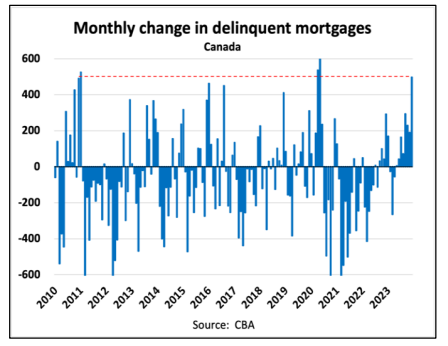

Mortgage Delinquencies

Mortgage delinquencies have been on the increaseEdge Realty predicts that mortgage arrears will return to long-term averages in the next 12 months to 18 months.

In December, arrears rates rose from 0.17% up to 0.18%. This was the largest monthly increase since April or May of 2020.

Credit Card Debt

Credit card debt has also risen.

The report concludes there are significant developments occurring and predicts by late spring it will become increasingly evident that the Canadian economy cannot sustain rates at their current level, which could lead to a shift in expectations toward rate cuts.

‘ Credit:

Original content by www.canadianrealestatemagazine.ca – “Canada’s Recession Indicators And Bank Of Canada Rate Cuts”

Read the full article here https://www.canadianrealestatemagazine.ca/news/canadas-recession-indicators-and-bank-of-canada-rate-cuts/