Canadian housing market experiences a dip in April: rising inventory and balanced conditions indicate shifts ahead

Advertisement: Click here to learn how to Generate Art From Text

The Canadian housing industry experienced a slight decline in sales in April, compared to March. This was despite the fact that the number of properties on the market had increased. This would usually signal the start of the spring season.

Since March, home sales in the United States have decreased by 1.7%. This decrease in sales was compounded by an increase of 2.8 percent in newly listed property, resulting in an overall increase of 6.5 percent in the number of properties for sale.

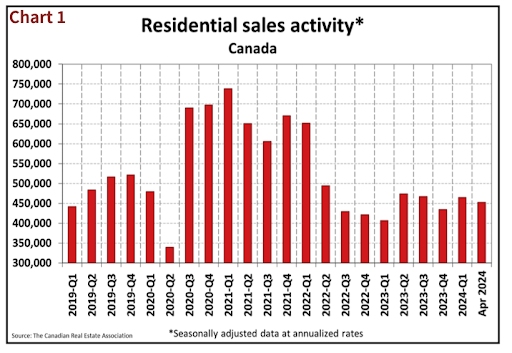

Trends over time

The peak in sales activity is around 2020 Q3 to 2021 Q3, with sales consistently exceeding 600,000, and peaking at close to 800,000. This surge can be attributed to many factors including low interest rate, a reaction to the COVID-19 epidemic where people were looking for better living arrangements, and a temporary rush of people to take advantage of favorable market conditions. Post-2021 Q3, there’s a clear downward trend, with sales gradually declining to below 400,000 units by April 2024.

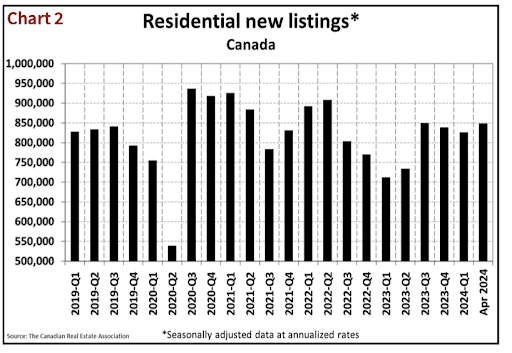

Listings show a pattern that is less volatile than sales. The peak in new listings coincides closely with peak periods of sales, indicating that the initial surge was supported by substantial numbers of listings, supplying enough supply to meet high demand.

After 2021, sales will continue to decline, but new listings will show a gradual decrease. However, they are still consistently above 500,000, which indicates that the market is still able to support a healthy supply of property, despite fewer transactions.

The correlation between listings and sales is strong, particularly during peak periods. High listing volume matched the high sales volume, suggesting that both supply and demand were balanced and the market was active. Listings also drop as sales begin to fall, but at slower rates. This could indicate that there is an oversupply on the market, or that sellers are less eager to sell.

Market conditions

The increase in actual transactions may partly reflect the timing of the Easter long weekend, and with sales down and new listings up in April, the national sales-to-new listings ratio eased to 53.4 per cent — slightly below the long-term average of 55 per cent. This is generally a good thing as a ratio between 45 per cent and 65 per cent is balanced, with readings above and below this range indicating seller’s and buyer’s markets, respectively.

The months of stock, another important metric was at 4.2 at the end of the month on a national level, up from the 3.9 months recorded in March. This is the highest level since pandemic began. This increase in inventory along with the balanced ratio of new listings to sales indicates a shift toward more balanced market conditions following a long period of tight supply.

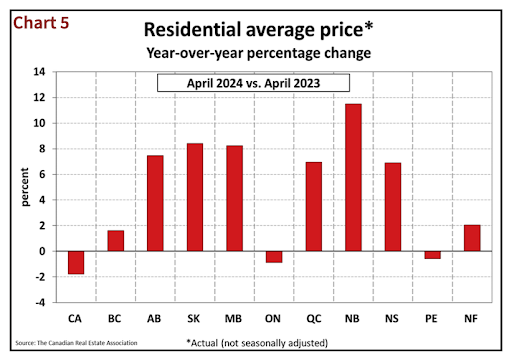

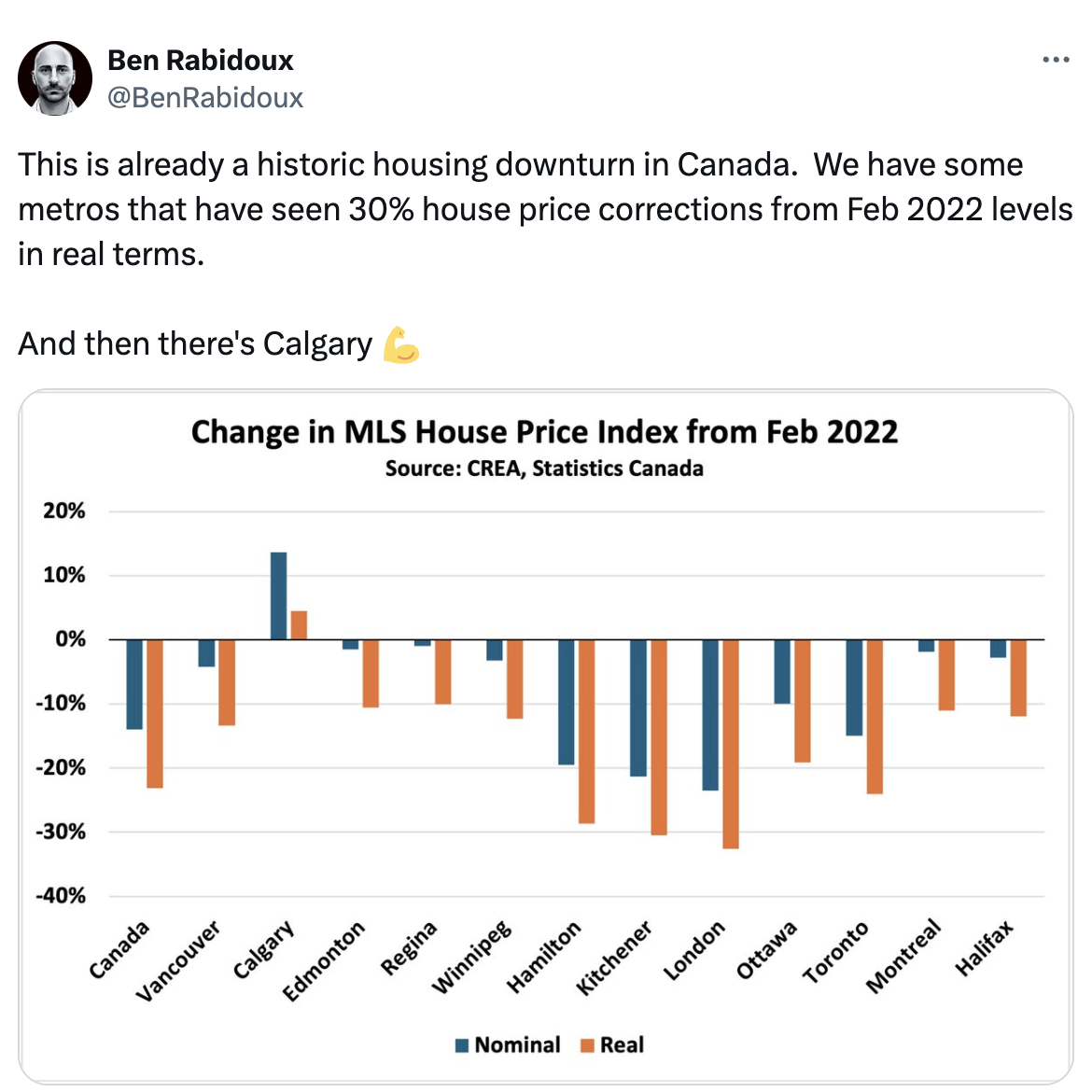

Regional variations

The national picture is balanced, but there are regional variations. Calgary, Edmonton, and Saskatoon have experienced steady price increases since the start of 2023. Prices in most other regions are sliding sideways.

In April, the Lower Mainland of British Columbia (which includes Greater Vancouver and Fraser Valley) saw a slight decline in prices month-over-month, ranging between -0.2% to -0.5%. These areas have seen positive price changes over the past year, with Greater Vancouver increasing by 2.7%, and Fraser Valley rising by 1.9%.

Ontario’s housing markets also exhibited mixed performance. The Greater Toronto Area saw a 0.4 percent increase in prices month-over-month, while other regions such as Kitchener-Waterloo (1%) Hamilton-Burlington (12%) and Ottawa (0%) experienced modest gains. Sudbury (5.9%) and Bancroft (3.4%) experienced more significant price changes.

In Quebec, the Montreal CMA recorded a 0.8% month-over-month decline in prices, while the Quebec CMA registered a 1.2% increase. The Maritimes including New Brunswick and Prince Edward Island saw modest gains in April.

The actual national average house price (not adjusted by season) was $703,446 at the end of April 2024. This is down 1.8% compared to April 2023. This decrease in the national median price over the past year is likely due to the cooling market conditions as well as increased inventory levels.

Spring market slower, with more buyer choice, bargaining power and oversupply

According to CREA’s senior economist, Shaun Cathcart, the spring market of 2024 is characterized by a healthier number of properties for buyers to choose from, but with less enthusiasm on the demand side compared to the previous year. Most real estate professionals would agree with this — we’re in a market that’s oversupplied compared to the past few spring markets we’ve seen and, as a result, there’s very little urgency among buyers, who are enjoying the rare opportunity to shop around.

James Mabey, chair of CREA’s 2024-2025 board of directors, noted that the increase in listings is resulting in the most balanced market conditions seen at the national level since before the pandemic.

Despite the fact that high mortgage rates make it difficult for some buyers to enter into the market, those who are able to afford to buy a home enjoy more choice and greater bargaining power. Mabey notes that the current balance of the market may not last long, given the underlying demand.

Personal, I see a transition in the Canadian housing market towards a more balancing state, with an increase in inventory, and a moderated price growth. Regional variations persist, however, indicating that some areas are stabilizing while others may still experience fluctuation.

As we move further into the spring and summer buying seasons, it’s clear that the market dynamics will continue to evolve, so both buyers and sellers should be keeping a close eye on the current trend.

‘ Credit:

Original content by realestatemagazine.ca – “Canadian housing market sees April dip: Rising inventory and balanced conditions signal shifts ahead”

Read the full article here https://realestatemagazine.ca/canadian-housing-market-sees-april-dip-rising-inventory-and-balanced-conditions-signal-shifts-ahead/