GTA housing markets stable amid low sales, high interest rates

Advertisement: Click here to learn how to Generate Art From Text

The Toronto Regional Real Estate Board reports that the Greater Toronto Area (GTA), housing market experienced stability in May. Home sales remained at a low level of 7,013 transactions.

This is to say, “stability”This is not what you would want in the middle a market which should be a spring one. In a typical calendar year, the number of transactions increases from January to May. When looking at an annualized context, it’s a significant 21.7 per cent decline from the 8,960 sales in May 2023, so it’s no surprise that Ontario Real Estate Association (OREA) CEO, Tim Hudak, has publicly called for rate cuts.

Unaffordable markets see very little transaction volume — a problem for the industry

Hudak’s comments bring attention to something that is painfully apparent in advanced economies with lower homeownership than Canada: unaffordable markets see very little transaction volume.

While this is not necessarily a bad thing for consumers of housing, it’s certainly a bad thing for an industry that depends on transaction volume to make a living. This is the reason why countries like Canada, the United States and Switzerland have a high number of realtors per person.

The GTA real estate market has seen a significant increase in the amount of leasing transactions.

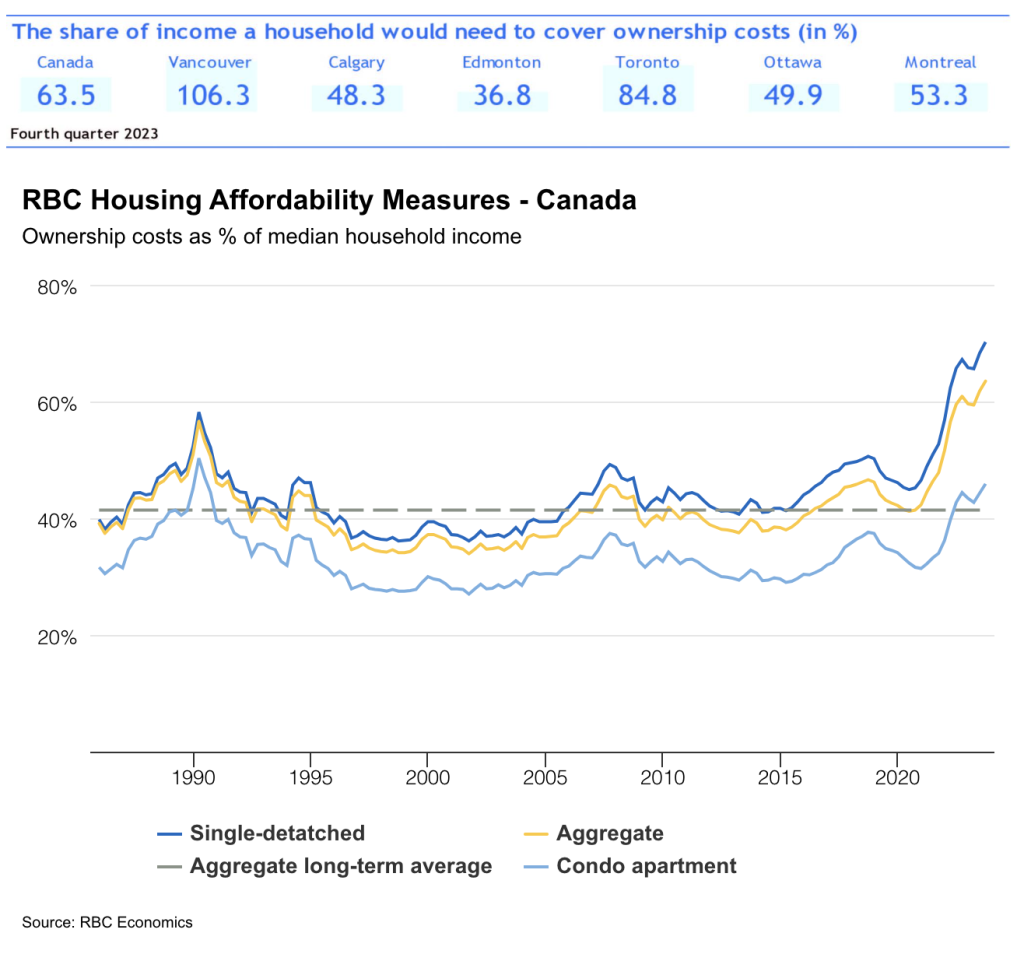

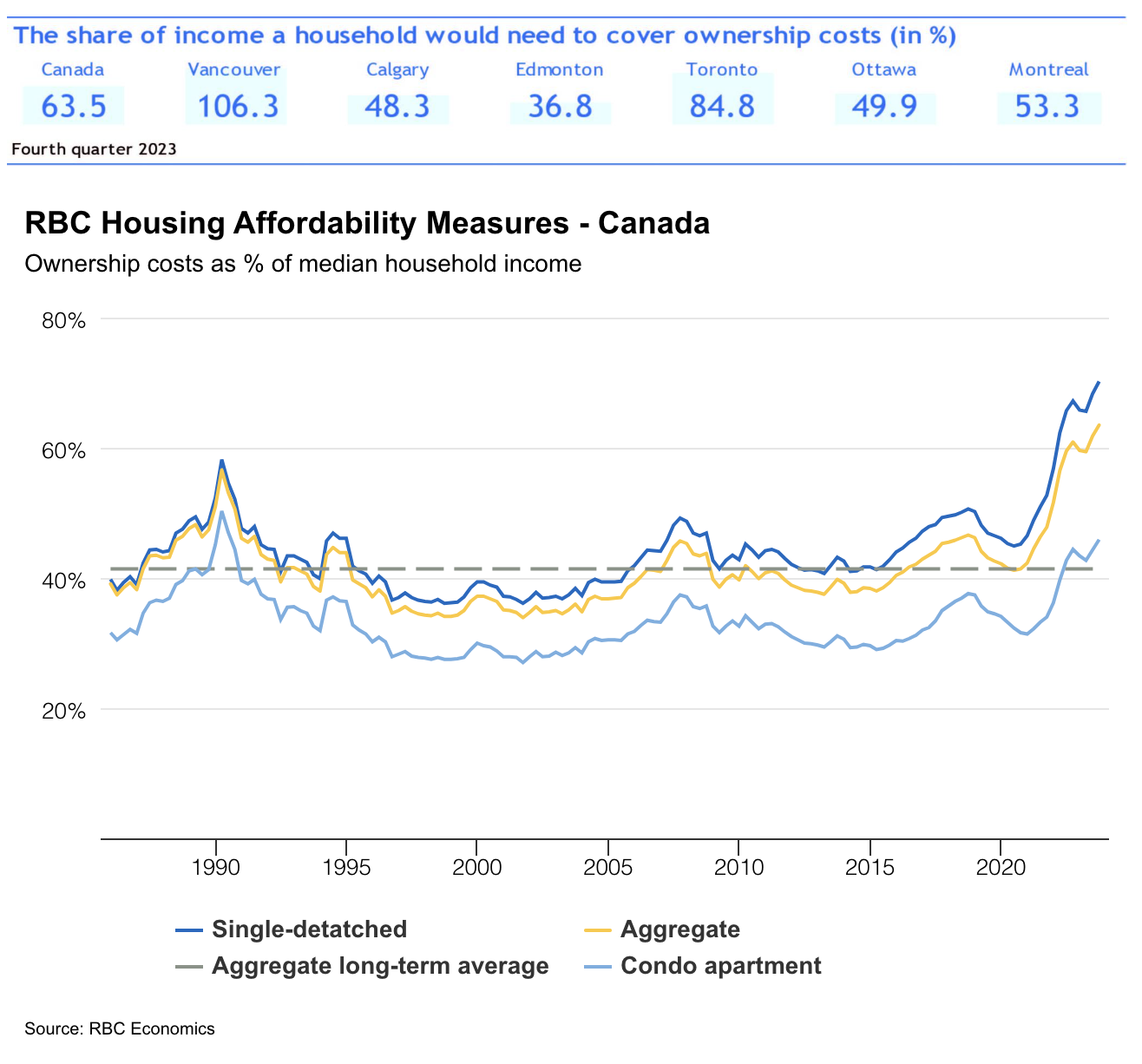

It has not been hard to find acknowledgment of Canada’s crippling housing affordability issue from economists at Canada’s biggest banks, for example, with RBC’s analysis:

People will buy houses as soon as they can afford it

In my opinion, housing affordability is key to a meaningful increase in transaction volume. It’s so simple that people call me stupid when I say it, yet it appears to be so easily ignored.

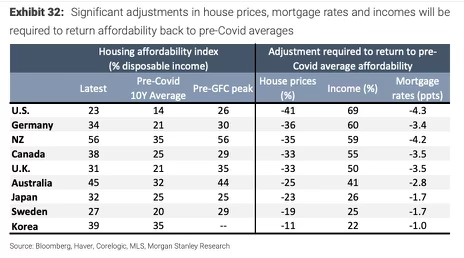

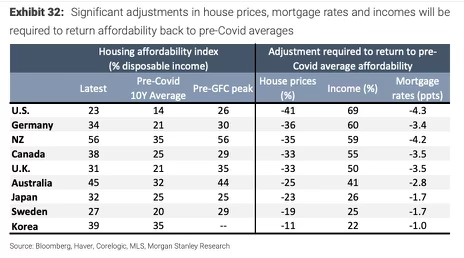

Bloomberg has outlined what Canada needs to do to get out of this affordability crisis.

- A 33 percent decrease in house prices and/or

- A 55 per cent rise in incomes

- Mortgage rates drop by 350 basis points

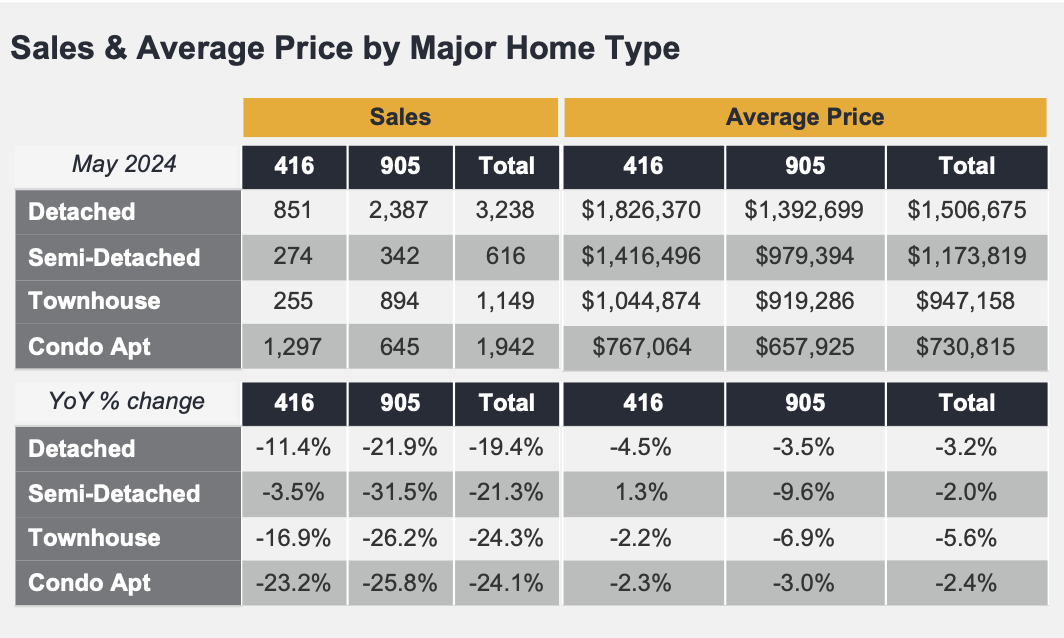

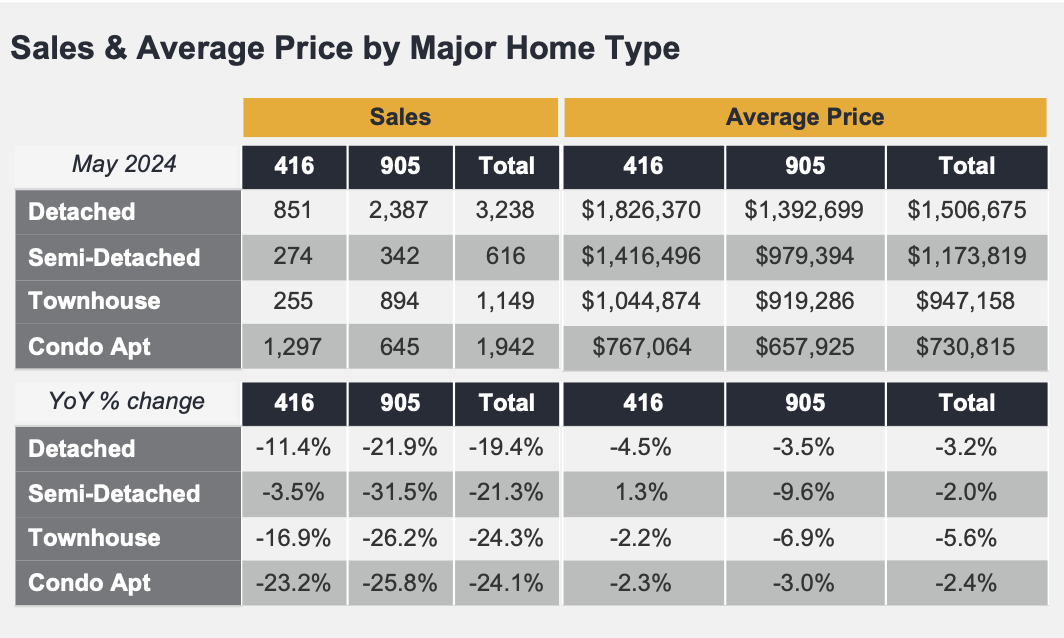

The average selling price for homes in the GTA in May was $1,165,691, marking a 2.5 per cent decrease from May 2023’s average price of $1,195,409. The MLS Home Price Index composite benchmark also saw a decline of 3.5 percent from the previous year.

Despite prevailing high interest rates, there was a modest month-over-month uptick in the average selling price on a seasonally adjusted basis from April 2024, indicating slight strength in the bid of buyers in today’s spring market.

“Inflation could be higher … if house prices in Canada rise faster than expected, or if wage growth remains high relative to productivity”

With this updated annual decline in house prices, it is clear that prices will continue to play a major role in restoring affordability. The house prices are down between 20-30%, depending on what metric you use and which market you’re using.

Mortgage ratesThis week, interest rates have begun to fall by 25 basis point and incomes are up a nominal 2,5 per cent since 2012. If incomes or interest rate changes do not materialize, it is reasonable to expect that house price increases will continue as fewer Canadians can buy homes.

The Bank of Canada acknowledged this in their press conference opening statement for the June rate cut — by stating that “Inflation could be higher … if house prices in Canada rise faster than expected, or if wage growth remains high relative to productivity.”

The Bank of Canada is therefore a bit stuck when it comes time to restore housing affordability. This is because a growth in house prices or wages would reduce the likelihood of further reductions.

Reasonable to expect a buyer’s market this summer

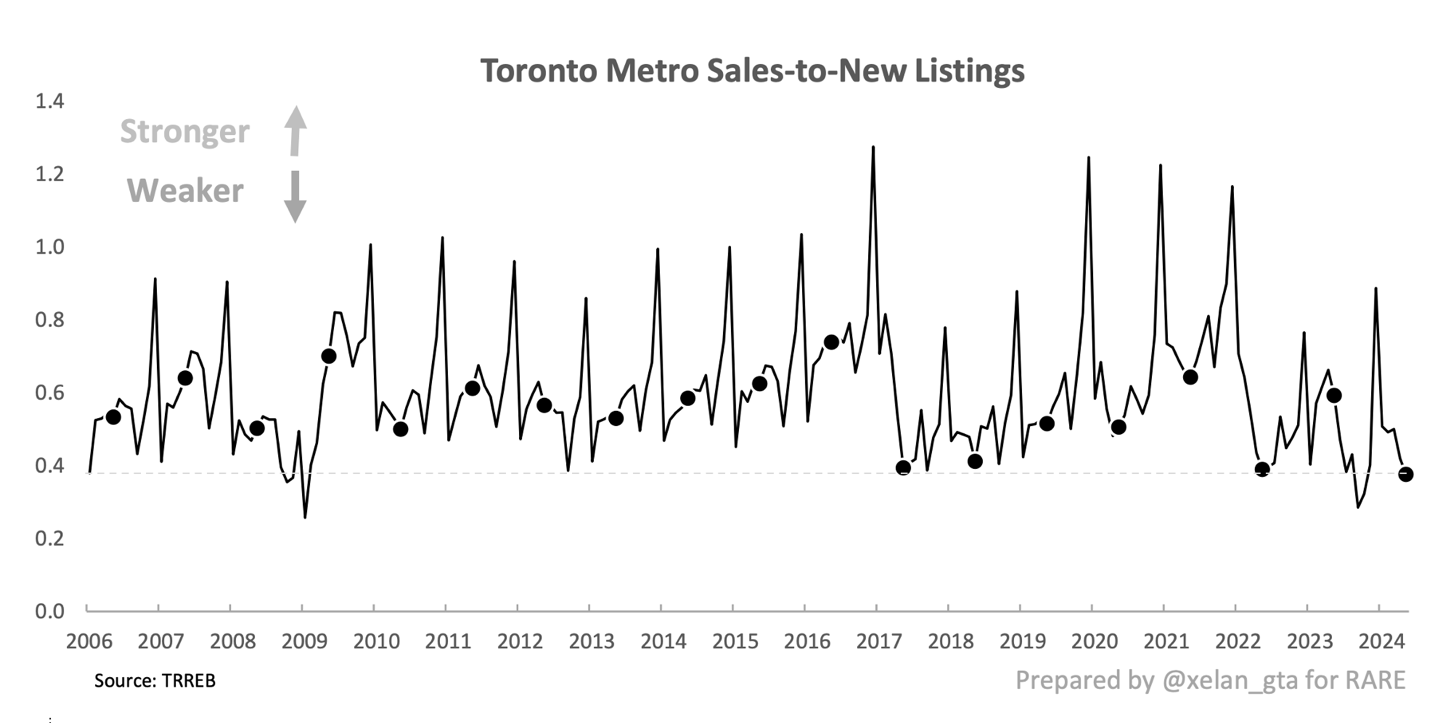

Despite the annualized decline in demand. New listings showed a different trend, with an increase of 21,1 per cent from year to year. The combination of the increased supply (listings) and decreased demand (sales) is sending us on an expedited path toward a buyer’s market, which is typically coupled with downward price discovery.

This new listing influx provided buyers with more choices and greater negotiation power, resulting in a less competitive environment compared to last year. The supply/demand imbalance led to a relatively low sales-to-new-listings ratio. Given supply growth alongside a typical summer decline in buying activity, it would be reasonable to expect a buyer’s market this summer.

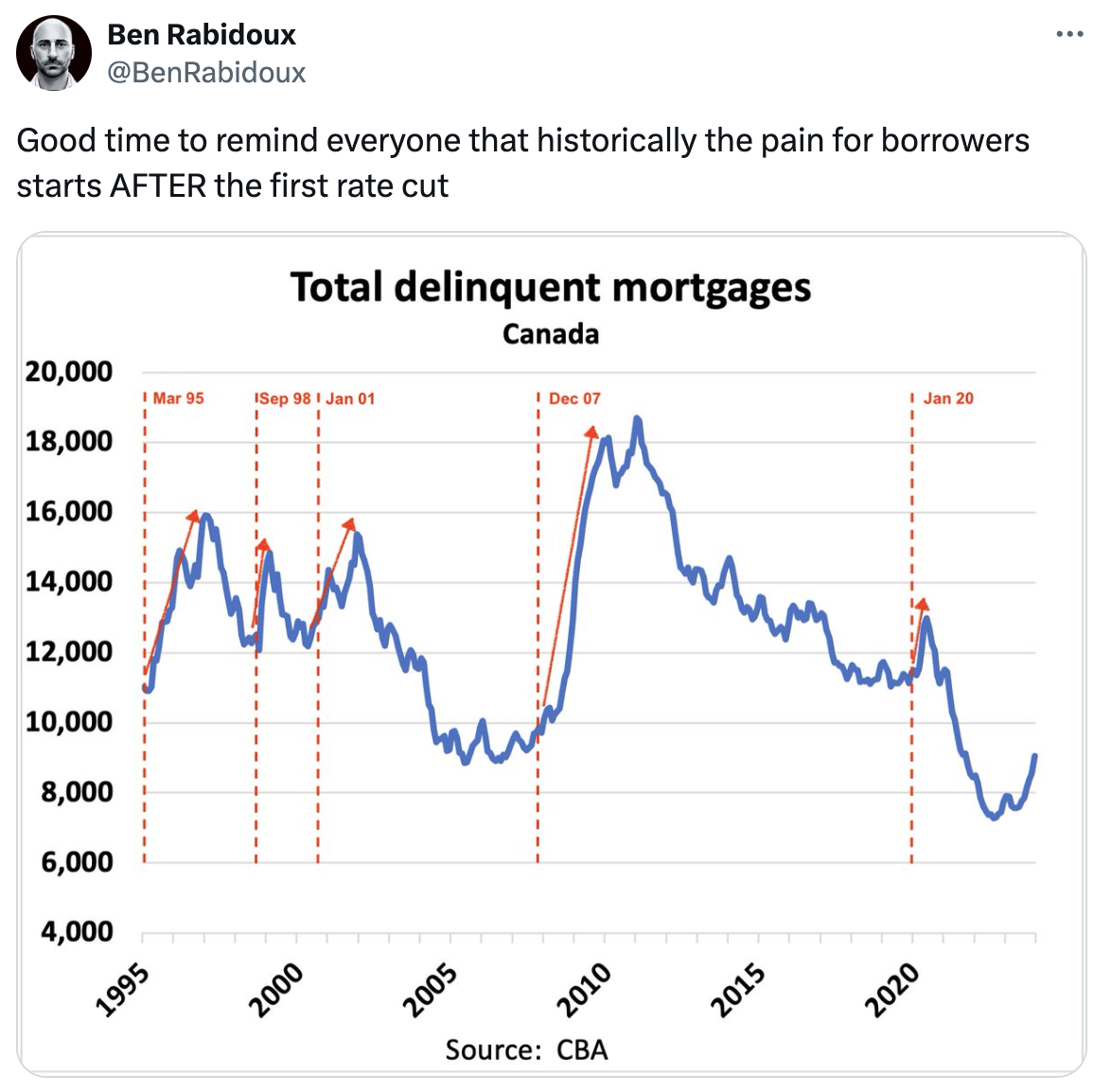

While many are optimistic that interest rate cuts will be the beginning of the end for unaffordability and low-volume challenges in Canada’s real estate market, this reality comes at a cost. Many of the increases in listing volume we see following rate cuts may be due to borrowers’ financial stress, despite the slight relief they receive.

Mortgage rate delinquencies rise after rate cuts

Two reasons are responsible for the increase in mortgage delinquency after rate cuts.

- The lagging effects of rate hikes on borrowers

- The reality that central bankers cut rates in response a bad economic data, leading to more bad data, such as rising unemployment. This reduces the ability of households to service debt

Ben Rabidoux from Edge Realty Analytics has done a great job in visualizing this:

Take care, there are dangerous curves in the road ahead

The current housing market is characterized primarily by cautious behavior from buyers, which is largely driven a result of high mortgage rates. According to Ipsos’ recent polling, a significant number of prospective homebuyers are holding off until they see concrete evidence of mortgage rates dropping. Even the Bank of Canada’s rate cuts may not accomplish that goal, given that the Canada five-year bond yield, the primary pricing mechanism for five-year fixed mortgage rates, just went up in response to June 7 data from the U.S.

It’s expected that as borrowing costs decrease over the next 18 months, a substantial number of buyers, including many first-time buyers, will be drawn into the market. This surge in the demand for rental properties is expected to ease some pressure on the market as new homeowners leave rental properties.

Jason Mercer, TRREB’s chief market analyst, pointed out that although high interest rates have tempered home prices, affordability will likely improve as borrowing costs decrease. This improvement may not last long as the increasing demand for homes is expected to push home prices back up.

Source: TRREB

‘ Credit:

Original content by realestatemagazine.ca – “GTA housing market sees stability amid low sales and high interest rates”

Read the full article here https://realestatemagazine.ca/gta-housing-market-sees-stability-amid-low-sales-and-high-interest-rates/