Market uncertainty in the GTA – Real estate sales are lowest since 2009.

Advertisement: Click here to learn how to Generate Art From Text

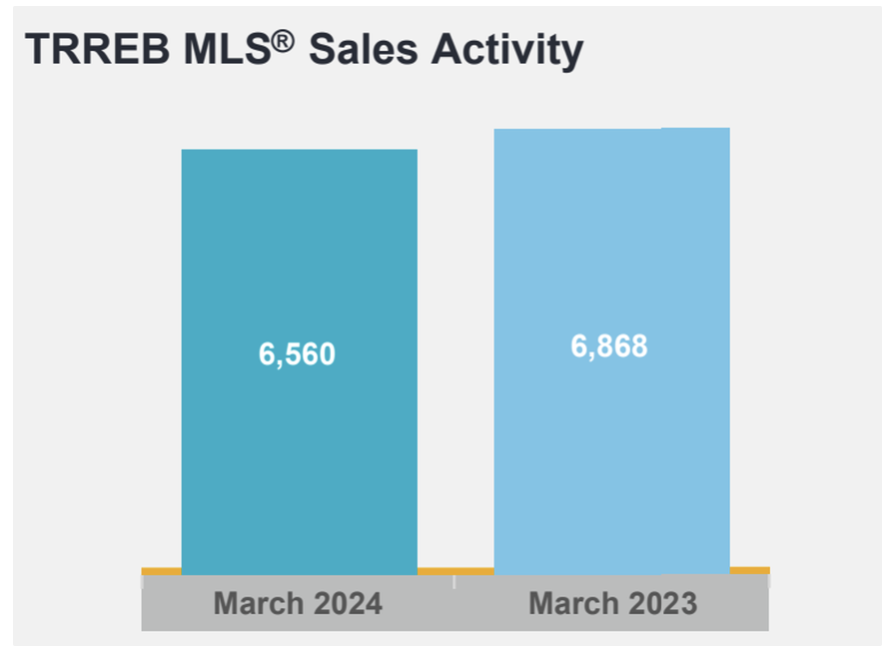

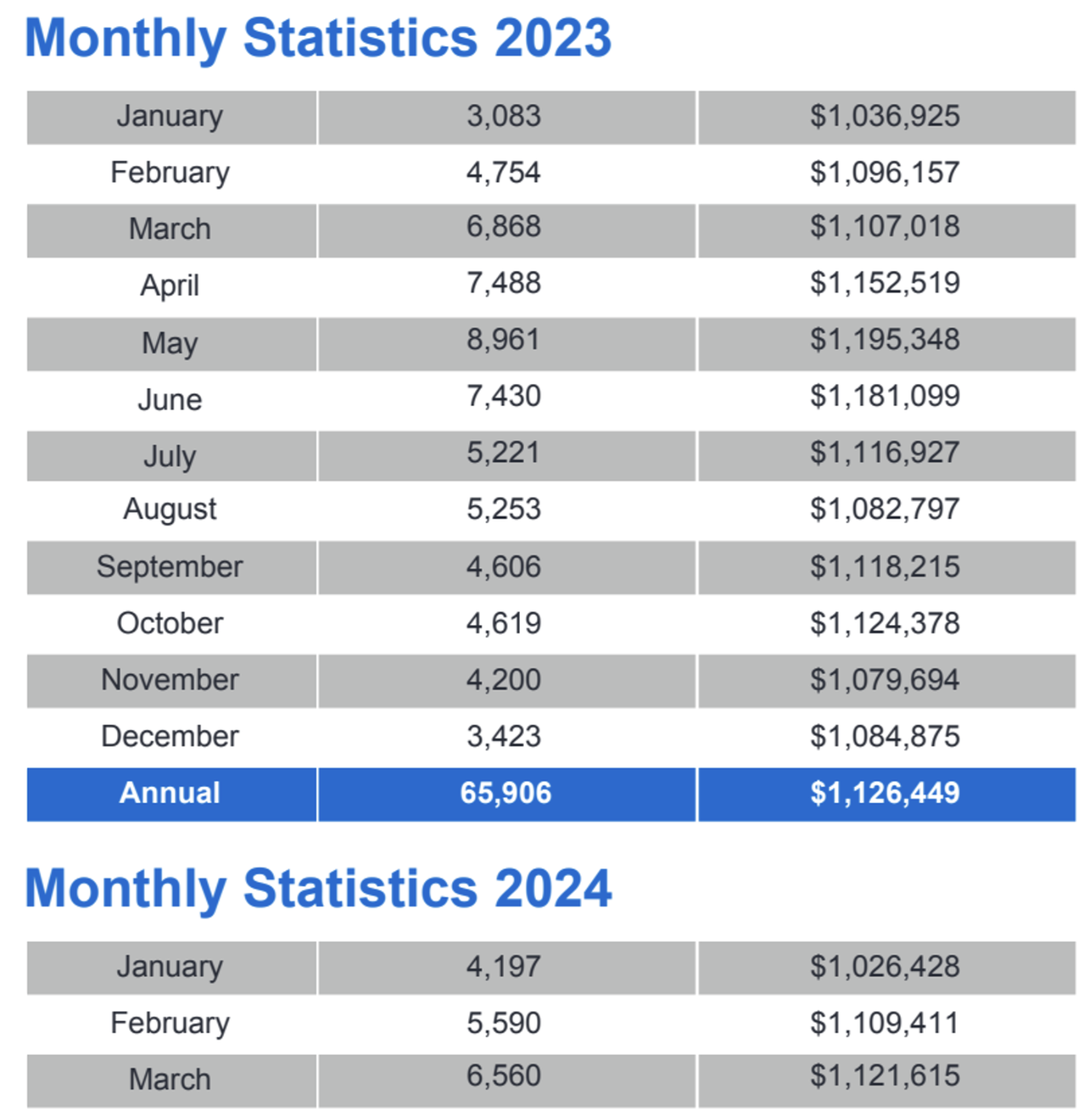

The number homes sold in Greater Toronto Area (GTA), during March this year, was the lowest in March since 2009. This was when the global economic crisis was at its height.

Given that 2023 was one of the slowest years on record in GTA real estate, it’s also remarkable that we saw fewer sales than last spring, though it stands to reason as 2023’s spring market was relatively hot, and the market lost momentum towards the end of the year.

Source: Toronto Regional Real Estate Board

The market has also slowed down, despite the fact that it showed signs of accelerating in the beginning of the year. This is because the hope of interest rate reductions continues to be pushed back further and further.

Source: Toronto Regional Real Estate Board

Prices could fall despite some optimism, but there is a heavy demand for first-time buyers.

Some optimism has been injected into the market by the federal government’s recent decision to increase Canadian Mortgage Bond issuance by 50 per cent ($20 billion). This increase adds liquidity to the lower end of the market, which has been evident in the bidding wars we’re seeing in entry-level product, especially under the CMHC insurance cutoff of $1 million.

It can be tempting to rely on first-time buyers to prop up the housing market by supporting the price floor — they’re certainly capable of it, given that the Bank of Canada identified that first-time buyers make up nearly 50 per cent of the purchaser market.

With that being said, it’s worth noting that if demand continues to be concentrated in the lower end of the market, it could gradually pull down the average and median prices and further impact sentiment.

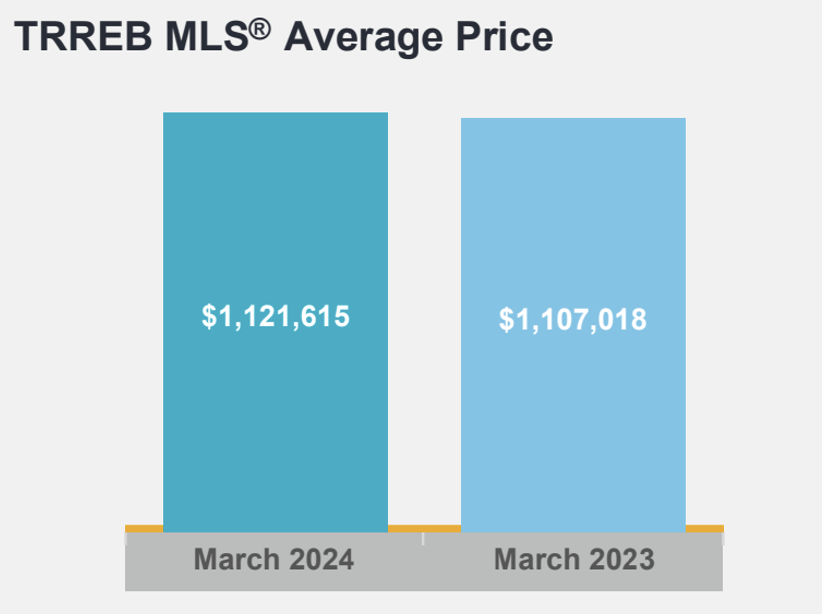

A slight price increase, but not close to spring 2023

Despite a better-supplied market, buyer competition led to a slight increase in the average home price, but nothing near what we saw in 2023’s record-setting spring market price growth. The GTA reported sales down by 4.5 percent and new listings up by 15 per cent.

Sales fell by 1.1 percent on a seasonally-adjusted basis compared to February. New listings also dropped by 3 percent. The first quarter saw an increase in sales of 11.2% over the year and an increase in new listings of 18.3%.

Source: Toronto Regional Real Estate Board

The market has gradually improved in the last quarter as more buyers have adjusted to higher interest rates. Homeowners expect a market recovery in the spring which will lead to a rise in new listings.

Two camps

According to Toronto Regional Real Estate Board president Jennifer Pearce, if lower borrowing costs are realized sales will increase further, new listings will absorbed and tighter market conditions push higher selling prices.

Those who may not share that optimism might feel that the headwinds of recession, reduced population growth and higher-for-longer interest rates present a significant challenge for Canadian real estate that we haven’t seen since the 1990s, and we know how that ended for housing — a recovery period which took 12 years to reach previous nominal house price peak (and 22 years when adjusted for inflation).

We hate to be cynical, but we think we’re in the latter camp.

‘ Credit:

Original content by realestatemagazine.ca – “Market uncertainty in the GTA: Real estate sees lowest March sales since 2009”

Read the full article here https://realestatemagazine.ca/market-uncertainty-in-the-gta-real-estate-sees-lowest-march-sales-since-2009/