The GTA housing market slowly creeps back to optimism

Advertisement: Click here to learn how to Generate Art From Text

A modest increase in home sales in the Greater Toronto Area for 2023 was attributed to a budding optimism in the housing market of 2024, according to reports. Urbanization, Canada’s leading research and analytics firm for the condominium, rental, and commercial property markets.

The Bank of Canada deciding to hold its overnight lending rate at 5% may have compelled sellers in Canada’s largest metro region to delay listing their homes in anticipation of ameliorated conditions this year. With rumblings south of the border that the Federal Reserve is poised to drop its policy rate, which would moved the Canada’s central bank to respond in kind, sellers are confident that market conditions will improve in 2024.

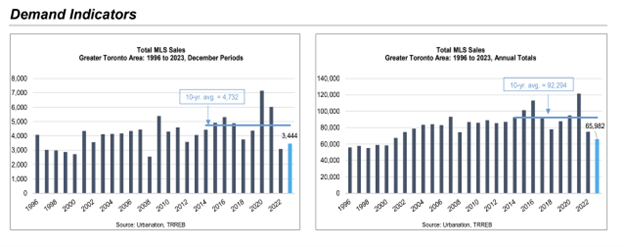

At 65,982, total sales in 2023 marked a 23-year low, declining by 12% year-over-year from 74,047, and falling well below the record high of 121,712 achieved a couple of years earlier when the BoC’s quantitative easing regime plunged its policy rate to 25 basis points.

Even so, there were signs that things would improve as 2023 approached. In December, despite being 27% lower than the 10-year average, sales rose 11% on a yearly basis to 3,444. However, that could preponderantly be explained by new listings decreasing year-over-year in December to 3,886 units—17% below the 10-year average, and the second lowest level for the month in 2022 years—leading to speculation that sellers are taking a wait-and-see approach to the market.

Active listings in the GTA decreased by 19% in 2023 compared to the previous year. At about three months’ supply (down from the four months in November), this was 11% less than the average of the last 20 years.

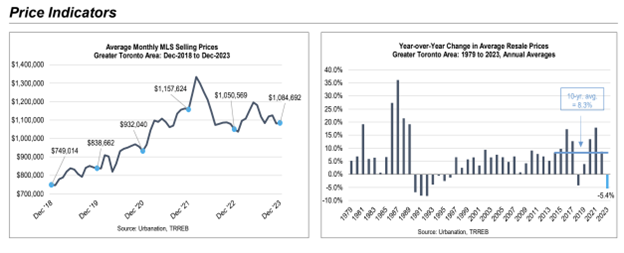

The average price of a GTA house increased by 3.2% to $1.084m in December, marking the seventh consecutive month of growth year-on-year. Home prices fell 5.4% from 2022, despite the high end of the year. Moreover, that was the first time GTA home prices declined since 2018, when they fell by 4.2% following the Kathleen Wynne government’s Fair Housing Plan, which included among other things a 15 percent tax on foreign buyers.

Still, the average home price appreciation over the past 10 years in the GTA was 8.3%, and 7.1% during the last 20 years.

In December, homes above $700,000.00 increased the most, even by 17%, for homes in this range. But for 2023 in its entirety, prices declined for everything above $600,000—which was particularly acute for homes priced at least $1.25 million, decreasing by 20%. This was in stark contrast to the increase of sales (+33%) that occurred for homes priced below $600,000. It is likely due to higher mortgage rates.

Condo sales have been one of the best performing assets over the past three year despite a 10% decrease in 2023. That isn’t too surprising considering sales surged by 51% in 2021. Condo inventory in the GTA decreased from 5.4 to 4.8 months between November and December.

‘ Credit:

Original content by canadianrealestatemagazine.ca – “Optimism Slowly Creeps Back Into GTA Housing Market”

Read the complete article at https://canadianrealestatemagazine.ca/uncategorized/optimism-slowly-creeps-back-into-gta-housing-market/