TRREB Report: June 2024.

Advertisement: Click here to learn how to Generate Art From Text

Spring is usually the peak real estate season, but home sales in May were sluggish. TorontoArea awaited anticipated mortgage rate cuts, which were announced by Bank of CanadaOn June 5,

“Recent polling from Ipsos indicates that home buyers are waiting for clear signs of declining mortgage rates. As borrowing costs decrease over the next 18 months, more buyers are expected to enter the market, including many first-time buyers. This will open up much needed space in a relatively tight rental market,” stated Toronto Regional Real Estate Board (TRREB) President Jennifer Pearce.

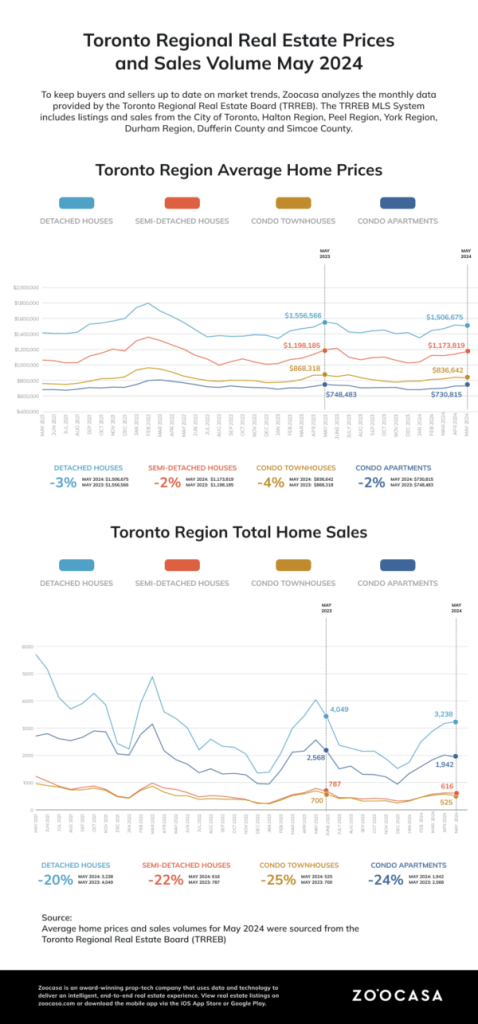

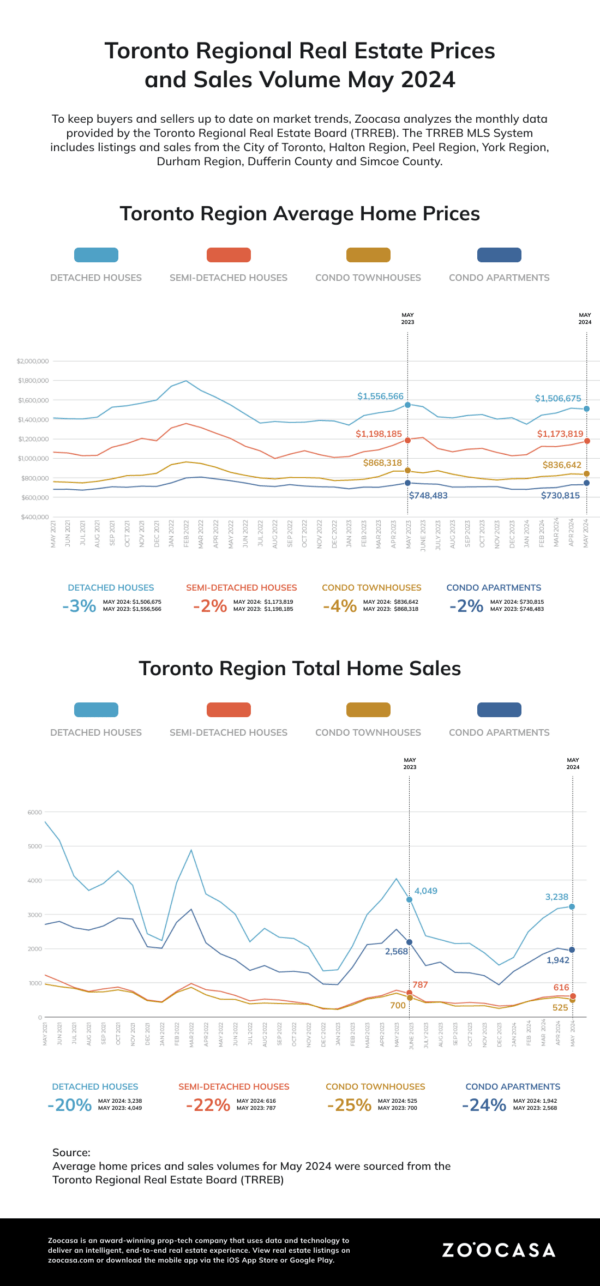

Buyers now have greater options and negotiating power with 83% more active listings than the previous year. In 2024 there will be 21,760 active listings, compared with 11,869 last year. This substantial increase in available properties may make it more challenging for sellers to get their listings noticed. The average selling prices in May 2024 were $1,165.691, a slight decline of 2.5% when compared to May 2023’s average of 1,195.409. As inventory increases and home prices are flat or slightly decreasing, prospective sellers should price their homes to attract attention.

“While interest rates remained high in May, home buyers did continue to benefit from slightly lower selling prices compared to last year. We have seen selling prices adjust to mitigate the impact of higher mortgage rates. Affordability is expected to improve further as borrowing costs trend lower. However, as demand picks up, we will likely see renewed upward pressure on home prices as competition between buyers increases,”Jason Mercer is TRREB’s Chief Market Analyst.

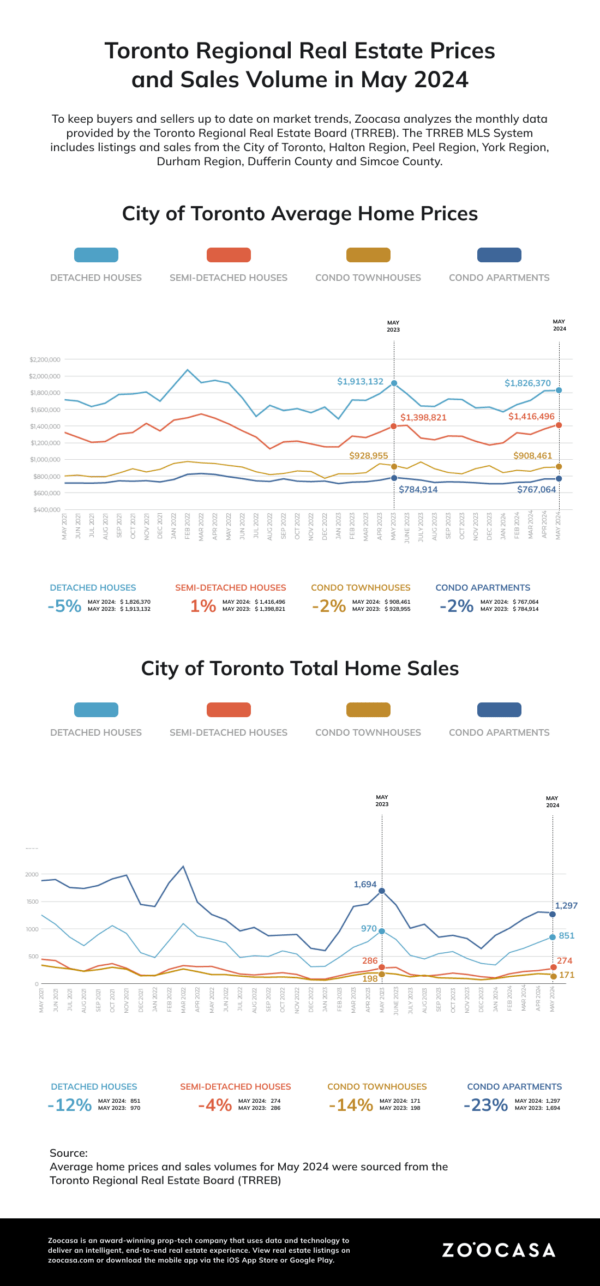

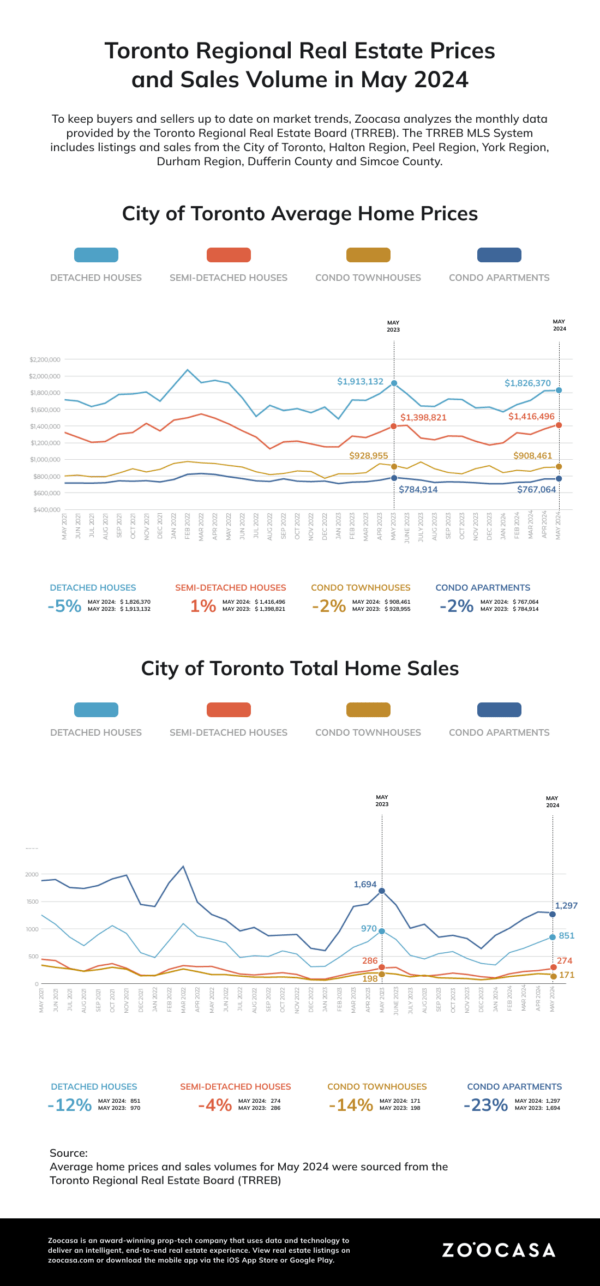

The majority of home sales in 416 have been condo apartments with 1,297 transactions. Condo sales are most active between $500,000 and $599,000, and $600,000.0-699. In the 905 area detached homes are most popular. There were 2,387 sales of detached homes in May compared with 851 in 416. However, there’s been a 21.9% total decrease in sales in the 905 area year-over-year. Overall, condo apartments, townhouses, and semi-detached houses have experienced drops of 24,1% and 24,3%.

Peel, York and Durham are the top three regions for home sales outside of Toronto. Year-to date, Peel region has recorded 5,369 home sales at an average of $1.062,880. York region has 5,521 sales at an average of $1.314,749 and Durham region had 3,983 sales averaging $933,565.

Peel region reported 576 transactions in May, York region had a total of 626, and Durham area had 597. Toronto had 851 transactions during the same period. For the month of May, the average home prices were as follows: Peel Region had an average price of $1,362,473, York Region’s average price was $1,692,777, and Durham Region’s average price was $1,059,756.

The significant number of transactions in May and the price fluctuations compared to year-to-date numbers highlight the dynamic nature of the housing markets in these high demand regions.

Buying or selling on the fence? Our real estate agents will help you navigate changing markets in Canada. Contact us now Contact an agent to discuss your needs.

Are you considering entering the market this summer?

Speak to our experts

‘ Credit:

Original content by www.zoocasa.com. “May sees dip in home prices: TRREB report June 2024”

Read the complete article at https://www.zoocasa.com/blog/trreb-may-2024/