What cottage buyers and sellers should know

Advertisement: Click here to learn how to Generate Art From Text

Cottage owners noticed a change in the 2024 Federal Budget announced in April: the capital gain inclusion rate increased from half (50%) to two thirds (66.7%). If you own a second residence, such as a cottage, you’ll be taxed 66.7% on all capital gains over $250,000.

But even before this change was announced, Ontario’s cottage country was heating up for an active spring season. Home prices have increased significantly since January, and new listings are flooding onto the market. So what’s prompting this enthusiasm? We spoke with a local eXp agent Karen HanesWhat buyers and sellers should expect this season.

Enjoying our content? Subscribe to our free contentWeekly NewsletterGet the latest real estate news, insights, and reports delivered straight to your mailbox.

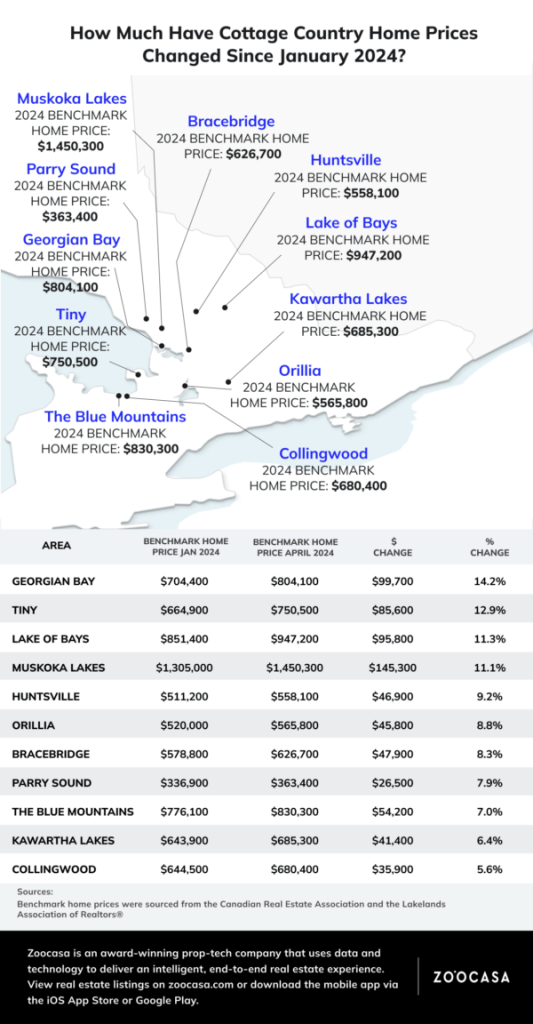

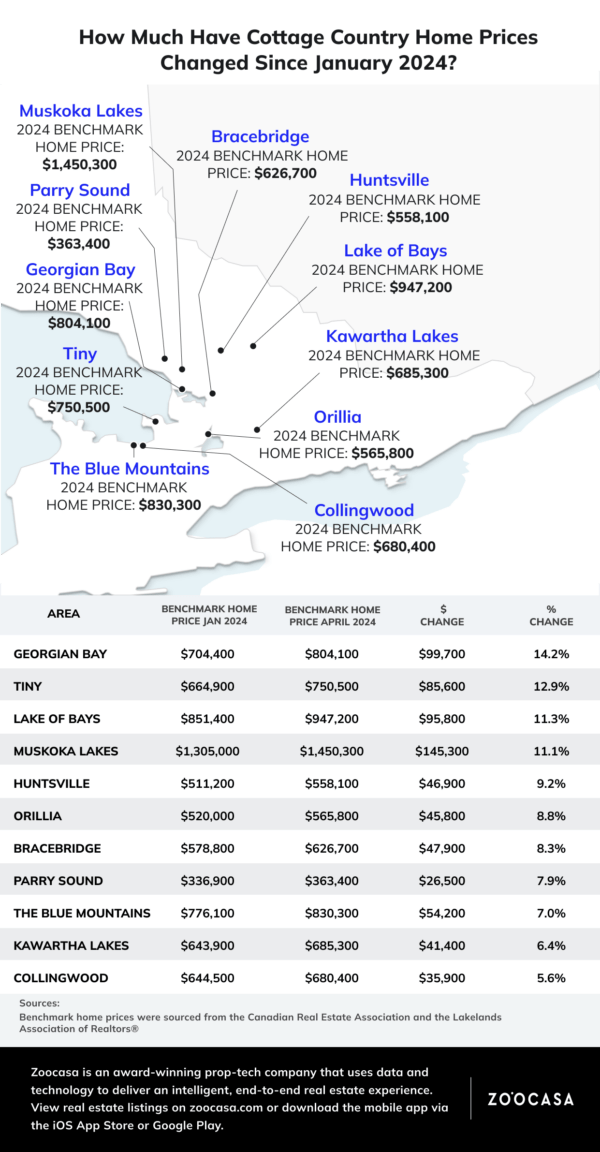

Zoocasa analyzed how benchmark home prices (which take all property types into account) for 11 markets in Ontario’s cottage country have changed since January of this year, and found that all but one market has experienced price growth of over 6% in just four months. Notably benchmark prices in Georgian Bay, TinyLake of Bays Muskoka LakesSince January 2024, the prices of homes have increased by more than 11%. In Muskoka Lakes that is a rise of more than $140,000, while in Lake of Bays or Georgian Bay it is a rise of over $90,000.

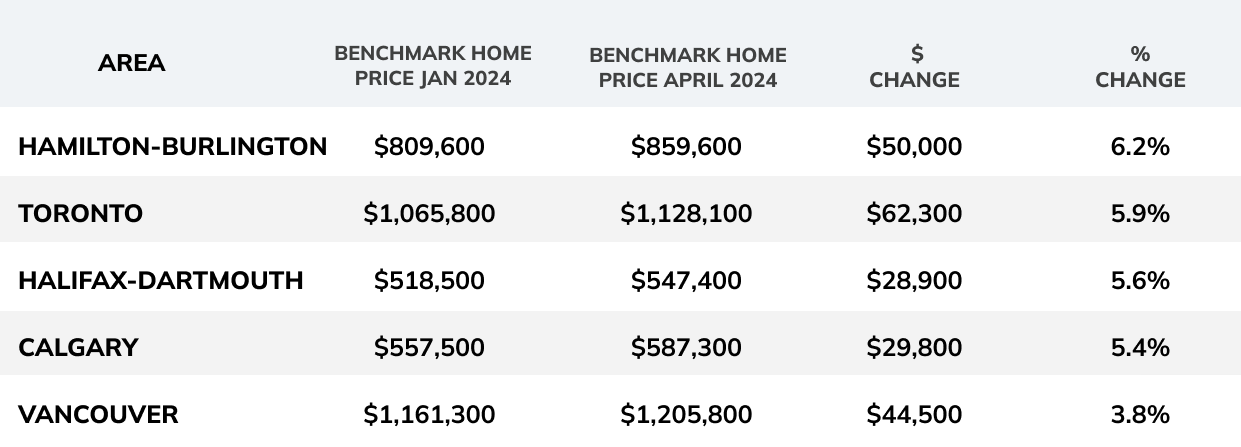

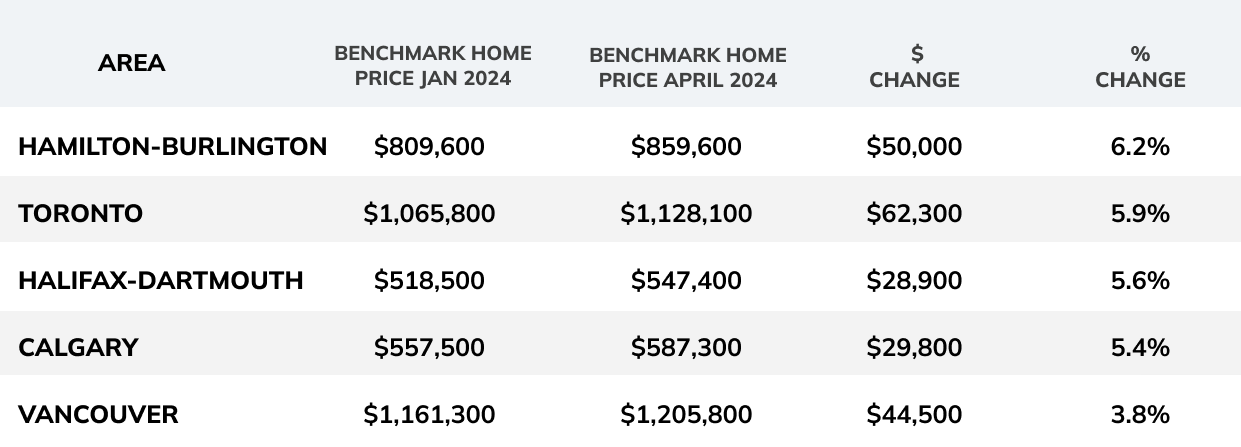

Benchmark price growth in some of Ontario’s cottage country is more than double that of other major Canadian markets. In TorontoThe benchmark home price, for instance, increased by 5.9% in January and in VancouverIt has increased by 3.8%.

With that being said, more homes are on the market this year than last year, so that’s keeping prices from skyrocketing. “The spring market is improving as people are optimistic,”Hanes, says “Homes are selling faster than last year, but it does depend on the house. If it’s overpriced, it’s going to sit, however, if it’s priced right it won’t linger on the market for too long.”

A slightly different story emerges when you focus on waterfront properties. The median price of waterfront properties in the Lakelands increased by 6.2% from January to date, but the price fell by 1.9% over the past year. Lakelands Central (which includes Midland, Orillia, Oro-Medonte, Penetanguishene, Ramara, Severn, Springwater, Tay and Tiny), and Lakelands North, which includes Algonquin Highlands. Bracebridge, Dysart et al, Georgian Bay Township, Gravenhurst, Highlands East, HuntsvilleLake of Bays Minden Hills, Muskoka Lakes, Parry SoundThe median price in Lakelands West, which includes The Archipelago and The Archipelago, has decreased by 4% annually and 0.7% annually. In Lakelands West, which includes Clearview, Collingwood, Grey Highlands, Meaford, The Blue Mountains, Wasaga BeachThe median price for waterfront properties in, which has fewer properties available on the market, increased by 16.1% and reached $905,000.

“I’ve noticed an uptick in buyers from last spring, and with more listings on the market, buyers have more choice than before. Though that higher inventory means it’s going to take a little more effort from sellers to ensure their properties get noticed,”Hanes explains.

We can see that the number of homes available for sale has increased significantly, especially in waterfront properties, where most cottage sales occur. In Lakelands North, the number of new listings in April increased 61% over the previous year. In Lakelands West, Lakelands Central and Lakelands Central new listings increased by 48.6% each.

Despite the fact that sellers are actively rushing into this year’s Spring Market, some buyers remain on the sidelines. “The sellers are there and ready, but buyer enthusiasm is still building as many people wait for interest rates to drop. Fixed rates have already come down with the anticipation of the Bank of Canada lowering rates so that is helping to boost the market,”Adds Hanes.

Still, year-over-year waterfront home sales are up in both Lakelands West and Lakelands North, though it’s important to note that with a small number of transactions happening in Lakelands West and Lakelands Central, percentage changes can appear larger than they might actually represent in terms of overall market activity.

Is the capital gains tax credit available with all these new listings? It’s difficult to pinpoint the increase in inventory on one specific reason, especially as spring is normally the season when sellers and buyers come out in droves. But the capital gains tax may be putting additional pressure on those who weren’t sure if they wanted to hang onto their secondary properties.

“I’m personally not seeing the changes to the capital gains tax resulting in any substantial impact from sellers,”Notes Hanes “The short notice left little time for preparation, so while I am getting questions about it, there’s no real sense of urgency from sellers. If this had been announced last year, the impact might have been different, but right now, it doesn’t seem like a major factor in property decisions.”

In fact, the Budget 2024Only 0.13% of Canadians earning an average of $1.4million per year are expected to pay more each year due to the increase in capital gains inclusion rate.

Prospective cottage country buyers shouldn’t be deterred from browsing for a summer retreat just because of the change in the capital gains tax, especially with so much extra inventory available on the market now. “This is an excellent time for buyers, especially those able to cash buy because there’s a lot more inventory to choose from. The best properties will be the first to go, so the sooner you get into the market the better selection you’ll have,” advises Hanes.

If you’re considering investing in cottage country this spring, let us help! Contact us nowIt is important to consult a reputable realtor regarding the home-buying and selling process.

Find your summer cottage now!

Contact us for a free consultation today

‘ Credit:

Original content by www.zoocasa.com: “What Cottage Sellers and Buyers Need to Know”

Read the full article here https://www.zoocasa.com/blog/capital-gains-tax-impact-cottage-country/