What the numbers say about investment opportunities

Advertisement: Click here to learn how to Generate Art From Text

Detroit is known as a city with affordable real estate. Many neighbourhoods offer homes at low prices. However, there is usually limited availability. Property costs in the area are lower than similar urban areas. This can mean lucrative opportunities for investors. Detroit is a good choice for those who are looking to invest for the first time or for those who want to avoid expensive properties.

Detroit is a city that has a lot to offer. Affordable residential propertiesThere are a variety of property types, and prices, to suit a range of budgets.

Joe Hammel, the FIRE Realty TeamNotes “Detroit has undergone revitalization initiatives which are drawing in people, businesses, and investment, while increasing property values and investment returns. Now is a good time to take advantage of the current low housing prices.”

Affordable neighbourhoods such as Grixdale, Chandler Park, and Regent Park are notable for their affordability. Areas like Boston Edison West or Downtown Detroit, however, tend to be more expensive, but still below average.

Oakland, Wayne and Macomb counties are located in the greater Metro Detroit area. They offer diverse opportunities for residents. real estate opportunitiesDifferent preferences, budgets and investment strategies are best suited for different properties. Oakland County is known for its diverse economy and affluent suburban areas. It offers upscale residential neighbourhoods, luxury real estate, and top-rated schools that appeal to wealthy investors and families looking for a suburban lifestyle. Wayne County has urban areas that are similar to Detroit and diverse suburban communities. This county offers a variety of real estate options in urban revitalization or established suburbs. Macomb County offers affordable housing, including newer developments in suburban areas, and opportunities for residential rentals.

According to Joe Hammel “The Detroit area’s single and multi-family rental market is robust, providing investors with stable investment opportunities. There is a range of investment alternatives in the Metro Detroit area worth exploring, though. Economic data and market trends back this up, and indicates significant potential for successful investing within the Detroit market.”

Real Estate Market Numbers

Affordability & Price Numbers

Metro Detroit’s market trend offers opportunities for value-oriented businesses Investors seeking propertyWith growth potential

Joe Hammel adds, “Detroit real estate offers some unique opportunities. You can discover properties priced below $100,000 that yield a monthly cash flow of roughly two hundred dollars and a double-digit cash-on-cash return on investment.”

In January 2024 for Detroit City, the median home listing price was $85,000. This is an increase of 11.5% over the previous year. Homes were listed on average at $74 per square feet. The median sold price, at $77,000, was slightly lower, indicating that properties were selling for around 2.95% less than their initial asking prices. Residential properties in Detroit spend a median 55 days on the marketplace before they are sold.

The median listing price of homes in Wayne County, MI (which includes Detroit and its surrounding regions) was higher, at $129900, but remained relatively stable from year to year. The median listing price was $104 per square feet, but the median sold price was $170,000. Homes in Wayne County tend to sell faster, with an average 44 days on the marketplace.

Housing is affordable. Multi-family housing options are also available in a wide range of budgets. This allows for more investors in the Detroit and Metro Detroit areas. There are currently many opportunities for investment and negotiations. A high demand could indicate that the area is a good investment opportunity.

Sale-to List Price Numbers

In 2023, all home types in Detroit had a sale-to-list-price ratio of 80.0%. This indicates a highly competitive market for buyers. In January 2024 this ratio increased to 97.5%. Despite the competition, prices are still relatively low. However, the high level of competition among buyers signals strong demand and suggests that there is confidence in the long-term value in owning properties or investing in Detroit’s real estate.

Investment vs. Return Numbers: Price-to-Rent Ratio

The price-to rent ratio is an indicator of the potential return on investment. Although buying housing in Detroit can be affordable, rents are usually high. Renting is more popular than buying in Detroit due to mortgage rates and other factors. Therefore, rental income can be very lucrative. In 2022, price-to-rent was 5.82 which is extremely favorable for landlords.

The average monthly rent in Michigan will increase by 13.89% to $1,505 in 2023. This is the second-highest rate of rental rate growth in America. The average rent in Metro Detroit is $1,671 a month.

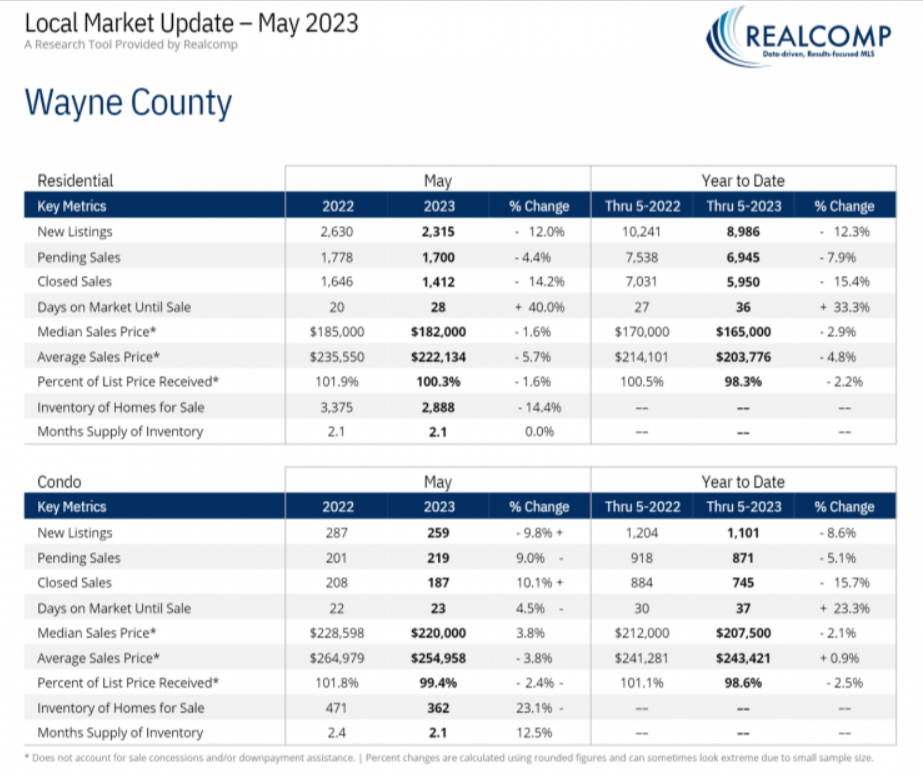

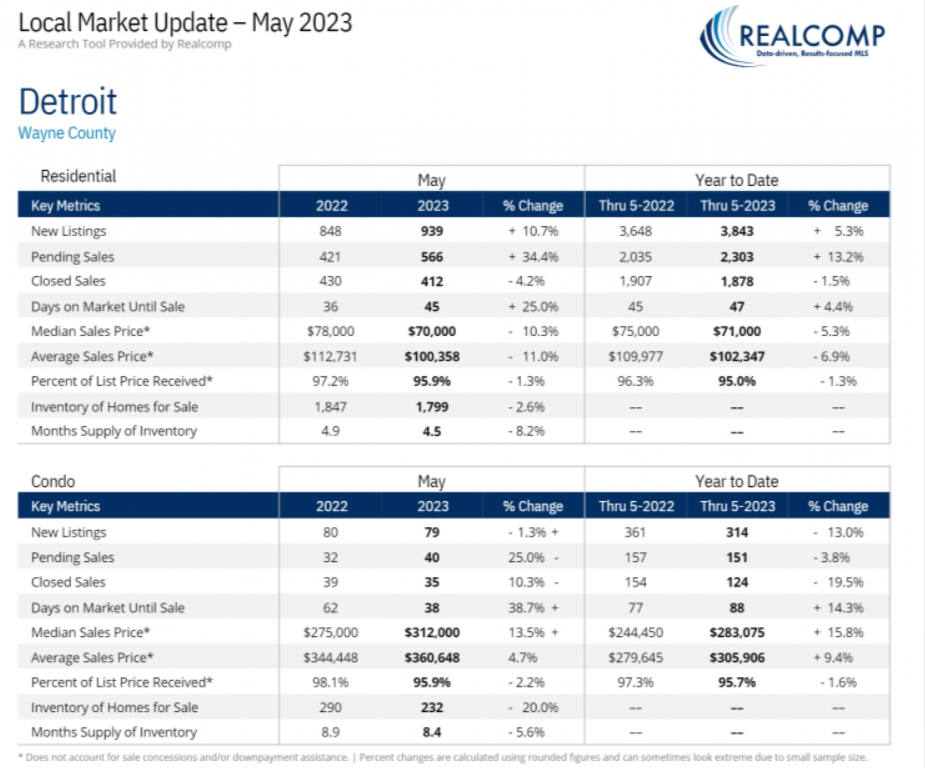

DAR Local Market Update – 2023 (Including Detroit, Hamtramck, Harper Woods and Highland Park) as of May 2023

Business Sector Numbers

Businesses moving their headquarters or new ones opening in a city are good indicators of economic growth. real estate investment potential. These businesses will bring more jobs and a larger population that will need housing in the area. Many people who relocate for work rent, at least temporary. This increased demand for commercial property can drive up rents and property values.

“With a growing business sector, there are going to be even more opportunities for growing real estate investments, and Detroit is in the middle of a period of significant growth,” adds Joe Hammel.

Motor City Match Round 24 will support the launch of 19 small businesses in Detroit in October 2023 with over $1 million in grants. A further $300,000 was allocated for 14 small businesses to improve their building. These grants are designed to boost small business growth in 18 Detroit neighbourhoods. This includes Mexicantown, University District Milwaukee-Junction Bagley, Central Southwest and Central Southwest.

Detroit is becoming a top startup destination, and tech is driving economic growth. Detroit is undergoing a significant period of change. It was named the top emerging tech eco-system by Startup Genome 2022 and ranked second globally in terms of VC growth by PitchBook 2023. This shift towards new directions and a focus on technology will likely have a positive impact on real estate investment.

Population Growth Numbers

Detroit’s population is increasing. In 2024, it will be 3,528,000 people, an increase of 0.2% over 2023. Projections show that in the next 5 years, the population will increase to 3,647,000, which is an increase of 0.83%. This growth will increase the demand for home ownership or rentals in the future.

Employment Numbers

A better employment rate and labour market helps to ensure that real estate investments increase in value and remain stable. It also provides a reliable pool of tenants. Compared to December 2022’s rate of 3.2%, Detroit has experienced only a very slight increase in unemployment as of December 2023, holding relatively stable at 3.3%. This is lower than the average unemployment rate in the United States which increased from 3.3% in 2022 to 3.5% by December 2023. The wages are also on par with the US average wage.

Numbers for Success

When investing in real estate, it’s crucial to thoroughly analyze all available information beforehand. A realtor who is investor-friendly, knows the local market and uses analytics can give you an edge.

Detroit is known for its pro-investment policy and is welcoming to Canadian investors. The border is only 10 minutes away. This makes Detroit an exceptional option, providing more cost-effective investment opportunities that are scarce in Ontario’s present real estate landscape. A realtor with experience can help investors take advantage of the investment opportunities Detroit offers.

You can also find out more about the following: FIRE Realty TeamThis advantage is that they are experts at analyzing ROI, identifying deals, and analyzing market trends, price, location and market trends. Their expertise makes investors who are looking to maximize returns and reduce risks on their Metro Detroit area property investment a valuable resource. Their success can be quantified as well with 464 successful deals in 2023 and a volume of $59,987.216. This includes single family investments, small and large multifamily investments, and even single family investments.

‘ Credit:

Original content by www.canadianrealestatemagazine.ca – “What The Numbers Say About Investment Opportunities”

Read the complete article at https://www.canadianrealestatemagazine.ca/news/metro-detroit-real-estate-what-the-numbers-say-about-investment-opportunities/